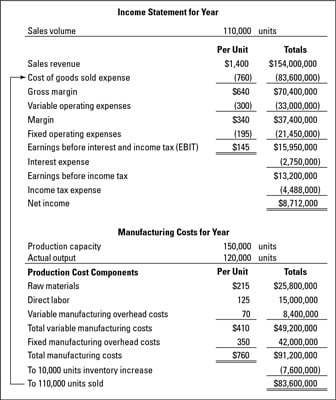

One method of calculating product costs for a business is called the actual costs/actual output method. Using this technique, you take your actual costs — which may have been higher or lower than the budgeted costs for the year — and divide by the actual output for the year. (This calculation is used for the business example shown in the sample income statement.)

The actual costs/actual output method is appropriate in most situations. However, this method is not appropriate and would have to be modified in two extreme situations:

Manufacturing costs are grossly excessive or wasteful due to inefficient production operations: For example, suppose that the business represented in the figure had to throw away $1.2 million of raw materials during the year. The $1.2 million should be removed from the calculation of the raw material cost per unit.

Instead, you treat it as a period cost — meaning that you take it directly into expense. Then, the cost of goods sold expense would be based on $750 per unit instead of $760, which lowers this expense by $1.1 million (based on the 110,000 units sold). But you still have to record the $1.2 million expense for wasted raw materials, so earnings before interest and taxes (EBIT) would be $100,000 lower.

Production output is significantly less than normal capacity utilization: Suppose that the business in the figure above produced only 75,000 units during the year, but still sold 110,000 units because it was working off a large inventory carryover from the year before. Then its production output would be 50 percent instead of 80 percent of capacity.

In a sense, the business wasted half of its production capacity, and you can argue that half of its fixed manufacturing costs should be charged directly to expense on the income statement and not included in the calculation of product cost.

Example for determining the product cost of a manufacturer.

Example for determining the product cost of a manufacturer.