One of the big changes in accounting software in the last couple of years (whether cloud-based or desktop-based) has been the introduction of bank feeds and bank rules. These two features combined can serve to automate an enormous amount of data entry.

With bank feeds, all transactions appear automatically in your accounts, without you having to enter anything.

With ‘rules’, these transactions are also coded automatically to the correct accounts. All you have to do is approve the way the software allocates each transaction.

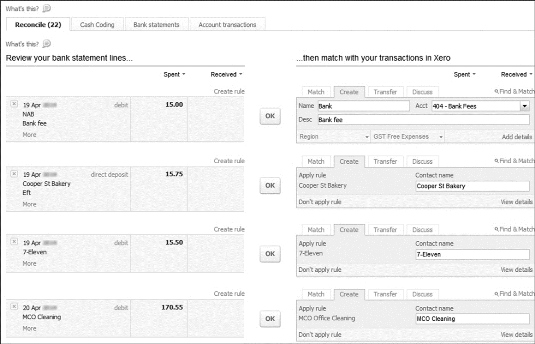

This figure shows how the concept works. (This example uses Xero, but the principles are similar whatever software you use.) On the left side, you can view all the transactions from the bank statement the moment you log on. On the right side, you can see how Xero ‘guesses’ how these transactions should be allocated.

Xero does this by applying bank rules that the bookkeeper sets up as they go along. In the figure, for example, the bookkeeper has created a rule stating that all payments made to MCO Cleaning should be allocated to Cleaning Expense.

All you have to do in this scenario is review the transactions and either click OK if Xero has guessed how to allocate the transaction correctly, or edit the transaction allocation if necessary.

You can see the crucial role that bank rules play with this kind of bookkeeping. With this in mind, here are some tips to help you get bank rules working the way they should:

Take care when naming bank rules and name rules so you can find them easily in the future. For example, with rules for bank withdrawals, it’s a good idea to include both the supplier name and the type of expense.

With most software, you can usually choose between creating a rule that runs on one bank account only, or that runs on all accounts. Unless you have a good reason otherwise, set up your bank rules so that they run on all accounts.

Usually it works best to create rules directly from the bank reconciliation of bank feed approval screen. This way, the software second-guesses what the settings for this rule should be.

Try and keep rules broad, rather than really precise. For example, a rule that says any payment that contains the word ‘Telstra’ should be allocated to Telephone Expense is going to work in more situations than a rule that looks for the exact phrase ‘Telstra Account 092834’.

Remember that rules can do a lot of the hard work for you. For example, most software allows you to split transactions across multiple accounts meaning that you could, say, allocate 80 per cent of your Telstra payment to Telephone Expense and the remaining 20 per cent to Personal Drawings.

Check all your general ledger accounts have the correct default GST tax codes applied to them. Otherwise, depending on the software, your bank feeds may automatically post to an account with the wrong GST allocation.

Bank feeds import data in slightly different ways, depending on the bank. For example, the bank feed from one bank may show a payment to a supplier with the supplier’s name in the Description field, but another bank feed may show the supplier’s name in the Payee field.

Avoid creating a rule for each scenario, but instead create a rule that codes all payments that have the supplier’s name in either the Description or the Payee field to the relevant expense.

Keep an eye out for duplicate rules. Duplicate rules can confuse how transactions are allocated.

Bank rules aren’t perfect! Don’t blindly accept how your accounting software allocates each transaction but instead, double-check how rules are applied and ensure that the right accounts are selected, every time.