If you’re working with a computerized accounting software package, you enter a transaction only once, which greatly simplifies your bookkeeping journaling. All the detail that normally needs to be entered into one of the journal pages, one of the General Ledger accounts, and customer, vendor and other accounts is posted automatically.

The process of posting first to the journals and then to the General Ledger and individual customer or vendor accounts can be very time-consuming. Luckily, most businesses today use computerized accounting software, so the same information doesn’t need to be entered so many times. The computer does the work for you.

The method by which you initially enter your transaction varies depending on the type of transaction. To show you what’s involved in making entries into a computerized accounting system, the following figures show one entry each from the Cash Receipts journal, the Cash Disbursements journal, and the Sales journal.

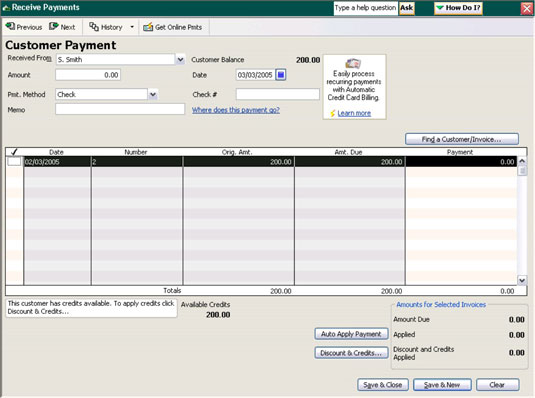

Entering cash receipts information

As you can see in the first image, to enter the payment by S. Smith, all you need to do is type “S. Smith” in the box labeled “Received From.” All outstanding invoices then appear. You can put a check mark next to the invoices to be paid, indicate the payment method (in this case, a check), enter the check number, and hit “Save and close.”

When you use a software package to track your cash receipts, the following accounts are automatically updated:

The Cash Account is debited the appropriate amount.

The Accounts Receivable Account is credited the appropriate amount.

The corresponding customer account is credited the appropriate amount.

That’s much simpler than adding the transaction to the Cash Receipts journal, closing out the journal at the end of the month, adding the transactions to the accounts impacted by the cash receipts, and then (finally!) closing out the books.

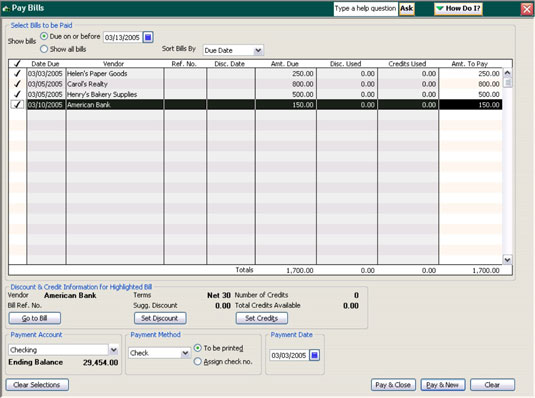

Entering cash payments information

Cash disbursements are even easier than cash receipts when you have a computerized system on your side. For example when paying bills (see the next image), all you need to do is go to the bill paying screen for QuickBooks. In this example, all the March bills are listed, so all you need to do is select the bills you want to pay, and the system automatically sets the payments in motion.

The bill-paying perks of this system include:

Checks can be automatically printed by the software package.

Each of the vendor accounts are updated to show that payment is made.

The Accounts Payable account is debited the appropriate amount for your transaction, which decreases the amount due to vendors.

The Cash account is credited the appropriate amount for your transaction, which decreases the amount of cash available (because it’s designated for use to pay corresponding bills).

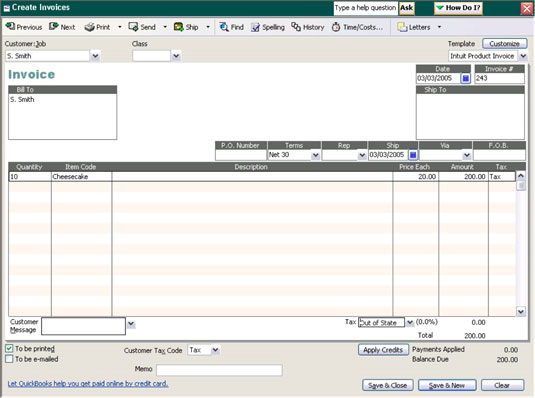

Entering sales information

When you make the necessary entries into your computerized accounting system for the information that would normally be found in a Sales journal (for example, when a customer pays for your product on credit), you can automatically create an invoice for the purchase. The next image shows what that invoice looks like when generated by a computerized accounting system.

Adding the customer name in the box marked “Customer” automatically fills in all the necessary customer information. The date appears automatically, and the system assigns a customer invoice number. You add the quantity and select the type of product bought in the “Item Code” section, and the rest of the invoice is calculated automatically. When the invoice is final, you can print it and send it off to the customer.

The preceding image doesn’t show sales taxes, but that information is easily calculated and added by the system. If sales taxes are indicated in the customer’s information, then those figures are automatically calculated.

Filling out the invoice in the accounting system also updates the affected accounts:

The Accounts Receivable account is debited the appropriate amount, which increases the amount due from customers by that amount.

The Sales account is credited the appropriate amount, which increases the revenue received by that amount.

The invoice is added to the customer’s outstanding bills so that when the customer makes a payment, the outstanding invoice appears on the payment screen.