Dates, From, and To window boxes

The Dates, From, and To boxes, for example, let you tell QuickBooks what reporting interval you want to show in the report. In other words, you use these boxes to tell QuickBooks the month, quarter, year, or whatever period for which you want to prepare a report.Columns drop-down list

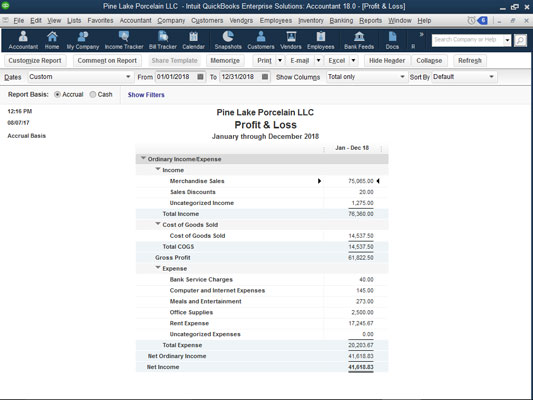

The Columns drop-down list displays a set of column choices. By default, QuickBooks displays a single total column for a report based on the time period you select. If you produce a report that summarizes annual income and expense data, for example, you can use the Columns drop-down list to tell QuickBooks that you want to see monthly columns. In this situation, QuickBooks shows an annual income statement, but it also shows columns for January, February, March, and so forth, providing some more detail on a certain time period, customer, or vendor. To see how this works, take a look at the figure. The profit and loss statement in the window is composed of only a Total column. A simple profit and loss statement with a single Total column.

A simple profit and loss statement with a single Total column.Now take a look at the following figure; it shows the same profit and loss statement, except this time, the Columns drop-down list shows Customer:Job. In this case, QuickBooks shows you a breakdown of your income and expenses by Customer and Job, as well as the total. The Columns drop-down list gives you a bunch of column options. Typically, some options make sense for the report that you’re working on; others won’t. Nevertheless, you should occasionally experiment with this tool. The Columns drop-down list often gives you a neat way to further segregate and refine your data.

A profit and loss statement with Customer:Job columns.

A profit and loss statement with Customer:Job columns.Sort By drop-down list

The Sort By drop-down list enables you to choose how information should be ordered in a report. For many types of reports, the Sort By drop-down list doesn’t provide any meaningful options. For other types of reports, however, the Sort By drop-down list provides handy ways to organize report information.Report Basis option buttons

A newly added feature for this year is the ability to toggle directly between accrual basis and cash basis on the report. The Report Basis option buttons — Accrual and Cash — let you specify whether you want QuickBooks to prepare a report on a cash basis or on an accrual basis. Now, quite honestly, you can’t simply convert between cash-basis accounting and accrual-basis accounting by clicking these buttons. Cash-basis accounting and accrual-basis accounting are too complicated for QuickBooks to figure out on its own. If you use accrual-basis accounting, for example, you must use the QuickBooks Accounts Payable feature, and you must record revenue and expense transactions when you earn revenue and incur expenses. Nevertheless, these Report Basis buttons enable you to quickly flip between cash-centric profit statements and accrual-like financial statements. And that’s pretty handy.In a nutshell, cash-basis accounting counts income and expense when cash moves into and out of a business. Accrual-basis accounting counts income when it’s earned and counts expense when it’s incurred.