The following steps describe how to create the most complicated and involved kind of credit memo: a product credit memo. Creating a service or professional credit memo works basically the same way, however. You just fill in fewer fields.

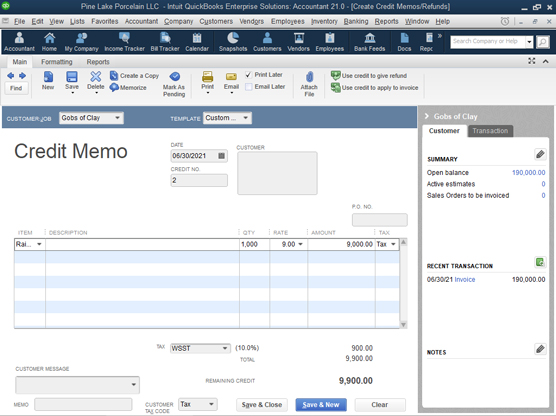

To create a product credit memo, follow these steps:1. Choose Customers→Create Credit Memos/Refunds or click the Refunds & Credits icon in the Customer section of the home page to display the Create Credit Memos/Refunds window (as shown).

The Create Credit Memos/Refunds window

The Create Credit Memos/Refunds window2. Identify the customer and, if necessary, the job in the Customer: Job drop-down menu.

You can choose the customer or job from the list by clicking it.

3. (Optional) Specify a class for the credit memo.If you’re using classes to categorize transactions, activate the Class drop-down menu and choose the appropriate class for the credit memo.

4. Date the credit memo (although going steady is optional).Press Tab to move the cursor to the Date text box. Then enter the correct date in MM/DD/YYYY format.

5. (Optional) Enter a credit memo number.QuickBooks suggests a credit memo number by adding 1 to the last credit memo number you used. You can accept the number or tab to the Credit No. text box to change the number to whatever you want.

6. Fix the Customer address, if necessary.QuickBooks grabs the billing address from the Customer list. You can change the address for the credit memo by replacing some portion of the usual billing address. Typically, you should use the same address for the credit memo that you use for the original invoice or invoices.

7. (Optional . . . sort of) Provide the PO number.If the credit memo adjusts the total remaining balance on a customer PO, you should probably enter the number of the PO in the P.O. No. text box.

Here’s my logic on this suggestion, for those readers who care: If you billed your customer $1,000 on P.O. No. 1984, which authorizes a $1,000 purchase, you used up the entire PO — at least according to the customer’s accounts payable clerk, who processes your invoices. If you make sure that a credit memo for $1,000 is identified as being related to P.O. No. 1984, however, you essentially free the $1,000 purchase balance, which may mean that you can use, or bill on, the PO again.

8. If the customer returns items, describe each item.Move the cursor to the first row of the Item/Description/Qty/Rate/Amount/Tax text box. In the first empty row of the box, activate the Item drop-down menu and then choose the item. QuickBooks fills in the Description and Rate text boxes with whatever sales description and sales price you entered in the Item list. (You can edit this information if you want, but doing so isn’t necessary.) Enter the number of items that the customer is returning (or not paying for) in the Qty text box. (After you enter this number, QuickBooks calculates the amount by multiplying Qty by Rate.) Enter each item that the customer is returning by filling in the empty rows of the list box.

In the case of inventory items, QuickBooks assumes that the items you’re showing on a credit memo are returned to inventory. You want to adjust your inventory physical counts if unsold items are returned.

As with invoices, you can put as many items in a credit memo as you want. If you don’t have enough room on a single page, QuickBooks keeps adding pages to the credit memo until you’re finished. The total information, of course, goes on the last page.

9. Describe any special items that the credit memo should include.If you want to issue a credit memo for other items that appear in the original invoice — freight, discounts, other charges, and so on — add descriptions of each item to the Item list.

To add descriptions of these items, activate the Item drop-down menu of the next empty row and then choose the special item. (You activate the list by clicking the field to turn it into a drop-down menu and then clicking the field’s down arrow to access the menu.) After QuickBooks fills in the Description and Rate text boxes, edit this information (if necessary). Enter each special item — subtotal, discount, freight, and so on — that you’re itemizing in the credit memo.

If you want to include a Discount item, you need to stick a Subtotal item in the credit memo after the inventory or other items that you’ve discounted. Then stick a Discount item directly after the Subtotal item. When you do this, QuickBooks calculates the discount as a percentage of the subtotal.

10. (Optional) Add a customer message.Activate the Customer Message drop-down menu, and choose a clever customer message.

11. Specify the sales tax.Move the cursor to the Tax list box, activate the drop-down menu, and then choose the correct sales tax.

12. (Optional, but a really good idea) Add a memo.You can use the Memo text box to add a memo description to the credit memo. You might use this description to explain your reasons for issuing the credit memo and to cross-reference the original invoice or invoices, for example. Note that the Memo field prints in the Customer Statement.

13. If you want to delay printing this credit memo, select the Print Later check box.I want to postpone talking about what selecting the Print Later check box does until I finish the discussion of credit memo creation. Coverage of printing invoices and credit memos comes up in a later section.

14. Save the credit memo.To save a completed credit memo, click either the Save & New or Save & Close button. QuickBooks displays a dialog box that asks what you want to do with the credit memo: Retain the credit, give a refund, or apply the credit to an invoice. Make your choice by clicking the button that corresponds to what you want to do. If you choose Apply to Invoice, QuickBooks asks for some additional information. QuickBooks saves the credit memo that’s onscreen and, if you clicked Save & New, displays an empty Create Credit Memos/Refunds window so that you can create another credit memo. (Note that you can page back and forth through credit memos that you created earlier by clicking the Next and Previous buttons.) When you’re done creating credit memos, you can click the credit memo form’s Close button.

If you indicate that you want to print a refund check, QuickBooks displays the Write Checks window and automatically fills out the check, linking it to the memo.